Industry news

The 5G-aliser: Time to pump up the volume

2021-11-19In early 2020, as a growing number of operators were launching commercial 5G services, it was clear that there were a wide range of factors that would affect the development of the market, from availability of spectrum and devices, to demand for high bandwidth services and private networks, and maturity of underlying technology and standards.

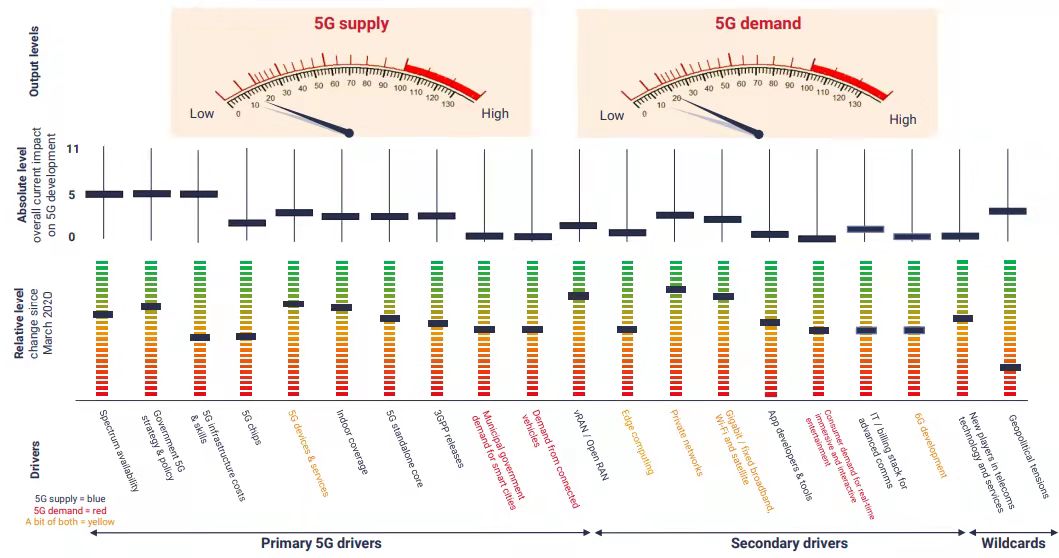

To make sense of how 5G would evolve – and amuse ourselves in the process – theSTL Partnersresearch team, Dean Bubley (ofDisruptive Analysisand who runs STL’s Network Futures research stream) and the editorial team at Total Telecom came up with the 5G-aliser. By plotting progress on the primary, secondary and wildcard factors impacting 5G development on the 5G-aliser, we understand which ones become more or less important over time, and can also build a high level view of supply and demand.

Over the last 18 months, we’ve revisited the 5G-aliser every quarter to track progress. Although both supply and demand have nudged up during this time, sadly no 5G drivers have come anywhere close to hitting number 11 on the dial yet. On the graphic, the absolute level measures total impact on 5G maturity, while the relative level measures the change since 2020 – allowing room for deterioration driven by COVID-19 or other external factors.

How 5G has evolved in 18 months to November 2021

(Source: STL Partners, Total Telecom)

In our latest update to the 5G-aliser, we estimate that supply of 5G including the ecosystem of devices and services around it has grown by 50% in the last 18 months, while demand has roughly doubled (change shown by the shadows of the needles on the dials). However, total supply and demand remain low as many of the elements that will truly bring the 5G market to life – mass market IoT, network slicing, O-RAN – are a long way from maturity.

What did Total Telecom Congress think?

At the end of October we shared the 5G-aliser atTotal Telecom Congressand opened it out to feedback from those attending the event.

Overall, it was well received and drove good conversations about the maturity of 5G, the key factors affecting its development, and the inflection points which will catalyse a more significant move in the needle than has occurred since we launched the 5G-aliser in March 2020.

Here are the highlights from the feedback and discussion with participants from telecoms operators, technology companies and analyst firms at Total Telecom Congress.

Should 5G demand be higher?

Someone from one of the UK’s leading mobile operators pointed out that there is significant demand for the increased bandwidth on its 5G mobile network. Even though the more advanced 5G capabilities and use cases are still in development, the first 5G use case – enhanced mobile broadband – is rapidly maturing. In this sense, the low level of demand on the 5G-aliser may not match more developed market operators’ experience. However, from a global perspective, with forecasts of 550-600 million 5G subscribers by the end of 2021, it is still in early stages of adoption.

Nevertheless, this is a valid point and we have reflected it in the latest update of our 5G-aliser by splitting out the supply and demand levels of 5G devices and services in our calculations. Supply of 5G devices and services remains constrained, especially as disruption and high demand in the semiconductor sector continue to ripple out, for example with Apple reporting a shortage of chips for its iPhones. However, demand is growing fast, particularly in North East Asia and developed markets. As a result of this break out, demand now outstrips supply on the 5G-aliser.

The challenge is that this form of demand will not deliver sustainable growth for operators – there is no change in business model, and premium tariffs will only deliver short term uplifts. There were some suggestions on how operators might monetise this demand further:

• Consider moving to speed tiered pricing. Although this can be expensive and difficult for operators to deliver, since it implies the ability to deliver top speeds across the entire mobile network, it is also one of the most effective strategies seen thus far for driving mobile ARPU, as seen in the Finnish market with Elisa and DNA. It is popular with customers because the value they get from it is tangible, they can see it.

• Explore opportunities to provide “critical QoS guarantees” on wholesale connectivity to enterprise customers in a B2B2X environment. The hypothetical customer discussed at the roundtable was Amazon, which participants thought would potentially be interested in leasing capacity on a 5G mobile network to offer fallback connectivity for Amazon Ring, as well as any other consumer IoT devices.

Aside from the overarching supply and demand discussion, there were good suggestions on more granular analysis of 5G drivers, which we will follow-up on in future iterations:

• Fixed wireless access: This is an important driver of demand for 5G for many telecoms operators, but the consumer versus private 5G opportunity is likely to play out very differently.

• Spectrum: This should be split out into licensed, unlicensed and local/private spectrum. This is particularly important when considering how 5G will penetrate indoor / campus environments, where neutral hosts may play a stronger role than MNOs, and also for customers like large events and sports stadiums that need coverage for all mobile networks in order to deliver a good experience.

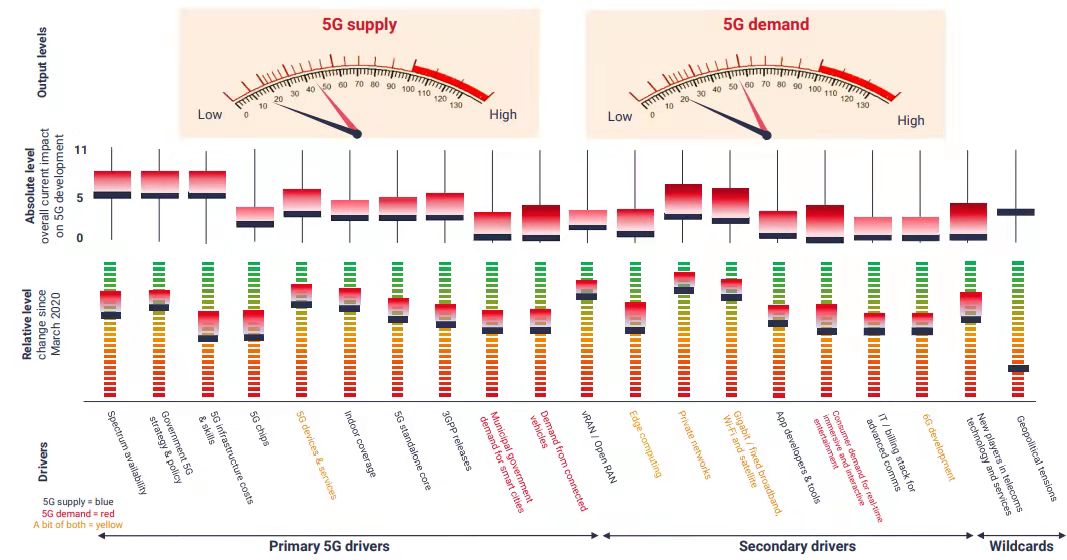

What will the 5G-aliser look like in 2023?

Given the overall limited development of 5G, with standalone cores only just starting to be deployed and no operator having yet fully rolled out Release 16, the most common question from the audience was “what would change this picture?”

To answer this question, we put together our view of what we think the 5G-aliser will look like two years from now. By the end of 2023, we expect demand will outstrip supply by a more significant margin (shown as red dials on the graphic). This is because the new capabilities 5G can deliver will be available to enough customers for it to be more tangible and real than it is today, but many elements such as O-RAN, network slicing, edge computing, and application developer communities and tools, are unlikely to have scaled yet.

Better understanding of 5G’s benefits means demand will further outstrip supply by 2023

(Source: STL Partners)

Information quoted from total telecom, If there is infringement, please contact to remove